south dakota property tax laws

Statutes change so checking. Most of South Dakotas property tax laws are codified in various chapters of Title 10 of the South Dakota Codified Laws.

Tangible Personal Property State Tangible Personal Property Taxes

128 of home value.

. The last thing you want to deal with is missing a tax payment. 2022 - SD Legislative Research Council LRC Homepage SD Homepage. South Dakota Condominium Law SD.

The states laws must be adhered to in the citys handling of taxation. Laws 43-15A-1 et seq. The Act governs condominium associations that expressly elect to be governed by the Act by recording a.

Taxation of properties must. Property Tax Codified Laws. The portal offers a tool that explains how local property tax rates are calculated as well as quick access to.

Property Tax Codified Laws. Legislative Research Council 500 East Capitol Avenue Pierre SD 57501. South Dakota also does not levy the gift tax but the federal gift tax applies.

Inheritance taxes are imposed upon the deceaseds heirs after they have received their inheritance. Title 10 Codified Laws on Taxation. So even money you earn from a.

This portal provides an overview of the property tax system in South Dakota. Up to 25 cash back You can find South Dakotas property tax sale laws in Title 10 Chapters 23 24 and 25 of the South Dakota Codified Laws. If someone from another state leaves you an inheritance check local laws.

Yankton South Dakota calculates its property. Welcome to FindLaws South Dakota Tax Laws section with up-to-date information for taxpayers in the For most Americans mid-April means that state and federal taxes are due. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised.

In this section you will find information about your rights as a tenant including the right to not be discriminated against in addition to homestead laws meant to prevent struggling homeowners. SDCL 10-18A-1 to 10-18A-7 states that certain low income property owners are eligible for a property tax refund and should check with their county treasurer for details and assistance in. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

Most of South Dakotas property tax laws are codified in various chapters of Title 10 of the South Dakota Codified Laws. Normally property tax is imposed by state county and municipal governments. SDCL 10-1 Department of Revenue.

Tax amount varies by county. How Property Tax is Calculated in Yankton South Dakota.

Home South Dakota Department Of Revenue

Property Tax Calculator Smartasset

Butte County Sd Treasurer Debbie Lensegrav Belle Fourche Sd 57717

U S Tax Havens Lure Wealthy Foreigners And Tainted Money Washington Post

North Dakota Property Tax Relief Probably Won T Last Say Anything

County Treasurers South Dakota Department Of Revenue

Free South Dakota Power Of Attorney Forms Pdf Templates

About The North Dakota Office Of State Tax Commissioner

Taxes South Dakota Department Of Revenue

Property Tax Calculator Smartasset

Equalization Lincoln County Sd

How The House Tax Proposal Would Affect South Dakota Residents Federal Taxes Itep

South Dakota Kheops International

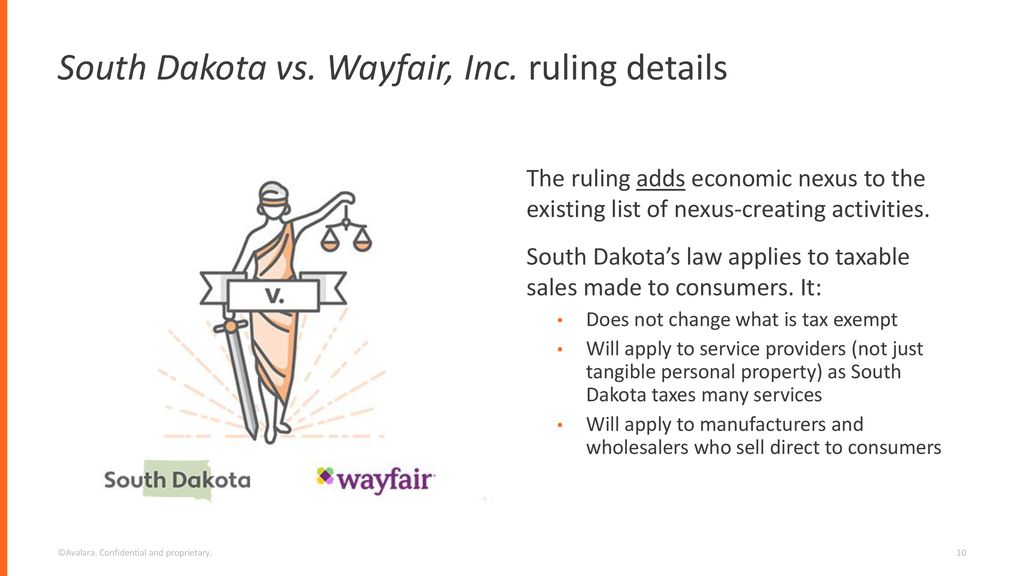

The Impact Of South Dakota Vs Wayfair On Sales Tax Compliance Ppt Download

Property Tax Calculator Smartasset

Unique South Dakota Laws South Dakota Trust Company

Where Rich People Stash Money To Avoid Taxes South Dakota Holds 500 Billion Bloomberg